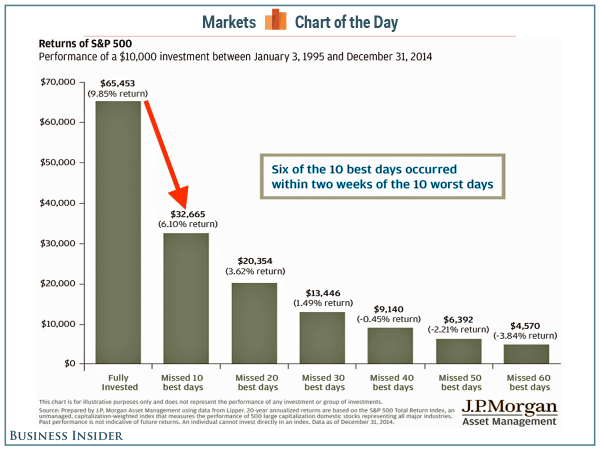

Many investors try to time the market for the highest return. Timing the market does not work, as shown in the infographic below. It would also be equally as disadvantageous to try and time a recession for maximum return.

For an investor that invest in the S&P 500 in 1995, the average annual return yielded $65,000 for each $10,000 invested if the inverstor held until 2015.

The information below shows that if the investor tried to time the market and missed even the best 10 days, the return drops a dramatic 50% to $32,000. That is pretty substantial. Missing the best 20 days breaks the $65,000 return all the way down to $20,000 which is a near 66% loss!!

It is a fool’s game to time the market. Invest steadily and over a long period of time and, at least historically, you cannot lose.

Related posts:

A look at how Obami administration is counting on bringing in revenue and spending it in fiscal 2011.Total reciepts is $2.567 trillion that has been used for Customs duties and fees $27.45, Estate and gift taxes $25.04, Excise Taxes $74.29, Miscellaneous $87.10Total outlays is $3.834 trillion and used for Net interest with $250.7, Nondefense $670.6, Medicare and Medicaid $1,435.2, Defense $744 and...

US self employed earn #13,720 compared to UK. This amount is already enough to buy 3843 big macs.US average self employed wage is $45,092 while on UK average wage in self employed is $31,372.Self employed workers in UK have to work for 146 hous. That is more than a us worker to earn the same as the average salaried employee.

Regardless of what your doing on the internet, privacy and security should always be one of your primary concerns. While TorrentGuard is focused on making bittorrent anonymous it is also a fully functional VPN to keep all your internet activities private and secure.Torrentguard is a leader in the online security industry – is proud to renew its commitment to defeat every online threat via the laun...

This shows the GDPs of US states compared to those of nations worldwide. All figures are in billions with the exceptions of Texas and California. It is not that low or not so high. While comparing in Canada.

Banking on the world bank shows that each countries around the world are depending on its assistance to help them support their often fragile economies.

According to study of student expenditures at yale University in 1915, one college freshman spent $4,500 in his first year. The least amount spent by a freshman that year was $200, or $4,201 adjusted for inflation. And according to national Retail Federation there are $10.5 billion gearing-up for campus this year.

You might think your getting what you pay for at the supermarket, but your actually getting a little less. A recent investigation by Consumer Reports fround that many of the everyday items you buy have been suspiciously shrinking, despite no similar reduction in cost. Does that orange juice feel a little lighter? That's because it is, even through you paid the same amount.

The strength of the yen has been one of the hottest topics in the tokyo summer, with the authorities last week stepping up verbal intervention after the currency hit a 15 year high againts the dollar.The yen's strength did not damage Japans april-june economic growth as the currency remained weaker than Y90.But the yen factor is not all bad for the economy. Half of japans exports to china are invo...

Upload your infographic here and contribute to our community.

Upload your infographic here and contribute to our community.

Leave a Reply