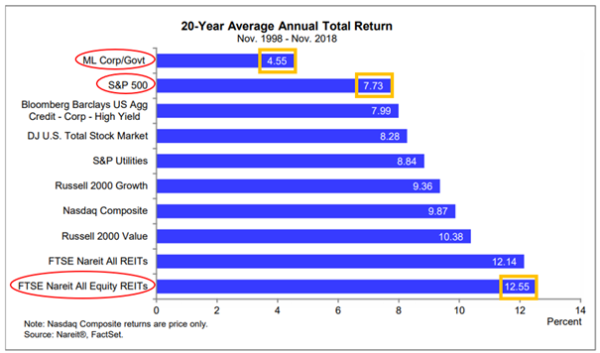

Not all markets are created equal. At least, according to this newest infographic. According to FactSet, over a 20 year average annual total return, which would include capital gains and dividends, REITs or Real Estate Investment Trusts have returned more than the S&P 500.

And this gain over the S&P 500 is pretty significant: 4.82% higher gain than the S&P 500. Even more interesting, the S&P Utilities index also yielded more than the S&P 500 by over 1%! That seems to be counter intuitive that a lower risk based asset yields more than an index, but in a lower interest rate environment, REITs, Utilities, and higher dividend players can have an advantage. With lower interest rates, companies can invest in longer term fixed assets and gain a better spread, as the rate these earning assets help produce is not affected as much.

So next time you think a utility company or a REIT is boring, check out the graph below!

Related posts:

Want to have a job that always get a tips? You can try hair stylist and barbers which receive 15-20% of the total cost of service,taxi drivers, waiters and waitereses, massage therapists, manicurists/pedicurists, Animal goomers, bartenders, bellhops and full service car wash attendants.You can also try bus and limo drivers but check the companys policy as some forbid tipping. Sommeliers/wine stewa...

Solar savings is surely effective. With Solar technology, you can have extra space storage plus you can also saves energy and saves money. Just take the storage properties, secure and convenient self-storage optoins with 34 states facilities and 2nd largest US self storage company that serves 34 years with their customers.

The S&P 500 index is a stock market index which tracks the top 500 public companies by market cap. This is generally considered a good indicator of the health of the United States economy since other indexes such as the DOW and Nasdaq have either too few equities in the index or are weighted too heavily toward technology respectively. The below infographic shows each time a news contribu...

This avant-garde Range Rover has capability at its core. It leads the way in progressive design from the renowned Range Rover floating roof to the refined interior with Suedecloth or Windsor leather options. Read more about the features of this avant-garde Range Rover below.

Many investors try to time the market for the highest return. Timing the market does not work, as shown in the infographic below. It would also be equally as disadvantageous to try and time a recession for maximum return. For an investor that invest in the S&P 500 in 1995, the average annual return yielded $65,000 for each $10,000 invested if the inverstor held until 2015. The informat...

Upload your infographic here and contribute to our community.

Upload your infographic here and contribute to our community.

Leave a Reply